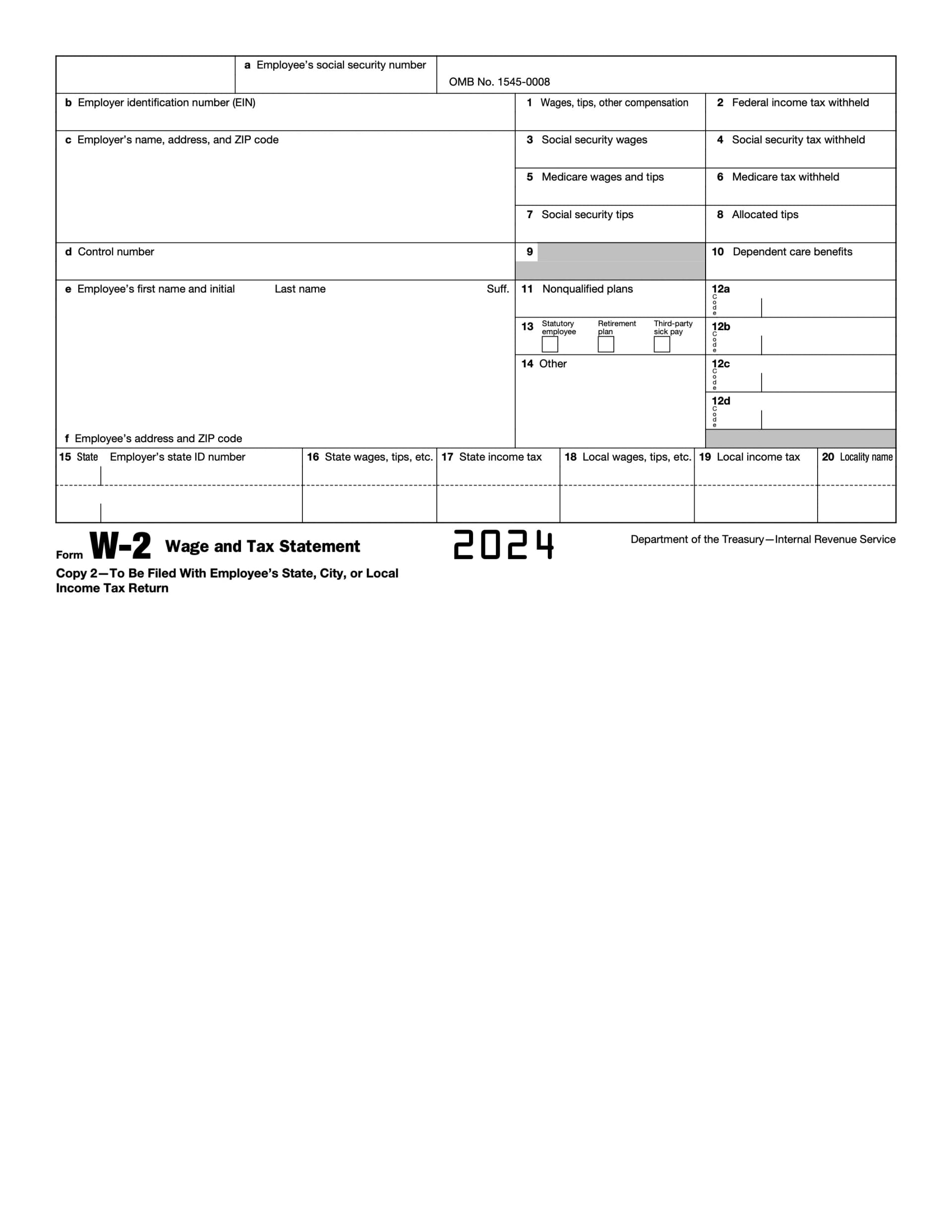

Fill out Form W-2 Online in 2026

Fill out W-2 form online in 2025 - simplify your tax season

18 760

Forms filled

2 391

Forms signed

1 327

Forms sent

Completamente Integrado Con

Get your Form W-2

![Fill out [form_name]](/_next/image?url=%2Fimages%2Ffill_1.webp&w=750&q=75)

Fill out Form W-2

Enter your personal or business information directly into the form — fast, accurate, and easy.

Sign the Form

Insert your legally-binding digital signature anywhere on the document.

Download or Share

Download your completed Form W-2 instantly or share it with others.

How to get a blank W-2 form?

Visit our site for a blank Form W-2 ready for completion and download, ensuring ease in filling and storing.

When is a W-2 form not required?

Self-employed individuals and contractors often use Form 1099-NEC instead of W-2 for income reporting.

How to fill out a W-2 form?

Load the W-2 in the PDF editor, enter details like EIN, wages, and taxes, then review and download.

Complete your Form W-2 now!

Fill out W-2 form online in 2025 - simplify your tax season

Fill FormWhen is a W-2 form due?

Employers must send W-2 forms to employees and the IRS by January 31st after the tax year concludes.

Who is required to fill out Form W-2?

Employers complete Form W-2 for employees to report wages and taxes withheld for tax filings.

Where to file a W-2?

Submit the completed W-2 to the SSA online or by mail and provide a copy to employees.

What is a W-2 form?

The W-2 details earnings and tax information essential for employee tax filing accuracy.

What is a W-2 form used for?

It reports an employee's annual income and taxes withheld, mandatory for tax return preparations.

How to sign W-2 form online?

Sign online by uploading your form to DocDoc Translate, adding details, then applying a digital signature.

What users are saying about our Online Tool

Frequently Asked Questions

Related Forms

An eviction notice is a pdf form that can be filled out, edited or modified by anyone online to formally notify tenants of lease termination and required property vacation.

A leave of absence agreement is a document that specifies the conditions of a worker's leave of absence with the employer, detailing terms for extended time off and return to work.

A Doctor's Note is a pdf form that can be filled out, edited or modified online. It confirms a medical appointment and serves as proof of a medical visit for employers or schools.